by Spacejock Software

WinXP & above / Mono 2.4 & above

An example of FCharts Pro usage

Note that this is a

generic example detailing how someone might use FCharts Pro to scan the market and research stocks of interest.

Disclaimer:

Any information presented by this website is not suitable as investment advice. You should seek professional investment advice before making any investment decisions.

I use technical data to locate trending stocks, and fundamental data to look for value. I'm using

Commonwealth Securities (Comsec) as the example online broker, but any will do.

Step 1

The first thing you need to do is import sufficient data for scanning.

This tutorial explains how to obtain and import ASX data for FCharts.

Step 2

In this example we're going to scan tickers in the ASX100 index. Therefore, we need to create an ASX100 watchlist and add the relevant tickers to it.

Here's how

Step 3

Let's do a simple scan which will pick out ASX100 stocks in an uptrend, or trading in a range. Click the Scanner button on the main screen, then set up the scanner so it looks like this:

The formula in the example is "ema2 > ema2[1]", which simply means the latest ema2 value is greater than the previous one. Ema is a trailing indicator, so if that's rising prices already have.

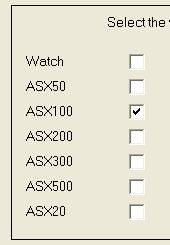

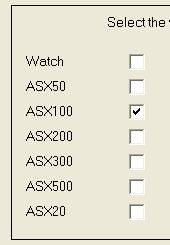

Next click the Advanced Settings button and untick all watchlists. Then select just the ASX100 list, as below:

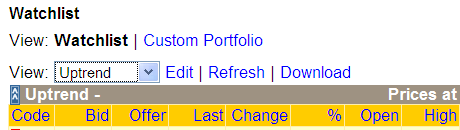

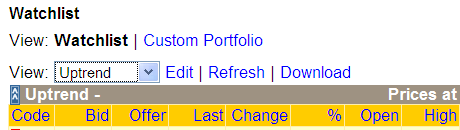

Run the scan and you'll end up with something like this in the results window:

(If you've ticked 'Simplified scan ratings' in the FCharts settings you'll just see the results under one heading instead of 'Big', 'Mid' and so on.)

Expand the results tree by clicking on nodes - e.g. Big (25) - and you'll see a list of tickers. Clicking each of these will update the main FCharts screen to show the chart. When I do this I'm looking for stocks with a clear up-trend, rather than those with no trend at all.

Uptrend example:

No trend example:

No trend example:

Each time I see a chart like the former (uptrend) I add that ticker to a new, empty watchlist. I call it 'research' or 'possibles' - something to show it contains stocks worth further investigation. Once I've gone through the entire list (23 stocks in this example), I end up with a watchlist containing perhaps 5-7 stocks of interest. Then I head over to Comsec, where I set up a new watchlist and add these tickers to it.

After that's done I inspect the fundamentals for each company, checking the P/E ratio, book value vs share price, dividend yield, debt to equity ratio and more. The exact requirements vary from one investor to the next, but when I find what I'm looking for I move that ticker into the final watchlist so I can keep a very close eye on it.